The landscape of global athleisure is undergoing a seismic shift as we head into 2026. For over two decades, Lululemon Athletica (LULU) has been the undisputed titan of the North American market, turning yoga leggings into a multi-billion-dollar cultural phenomenon. However, as the final weeks of 2025 unfold, the company finds itself at a crossroads.

While the brand is experiencing a "chill" in its home territory, it is simultaneously igniting a "gold rush" in international markets—specifically China. This divergence raises a critical question for investors, competitors, and fashionistas alike: Is Lululemon’s global expansion strong enough to protect its crown while its U.S. engine loses steam?

I. The North American Plateau: Facing the "Newness" Crisis

For years, Lululemon enjoyed a "bulletproof" reputation in the U.S. and Canada. But recent quarterly earnings have revealed a rare vulnerability. Revenue in the Americas has slowed significantly, with comparable sales showing a surprising dip.

The Fatigue of the "Core" Assortment

Outgoing CEO Calvin McDonald recently addressed the elephant in the room: a lack of product innovation. While the Align and Wunder Train series are legendary, the U.S. consumer is currently craving novelty. Without a consistent stream of "must-have" new silhouettes, the brand has seen a drop in foot traffic.

The "Alo & Vuori" Effect

The competitive landscape has never been more crowded. Brands like Alo Yoga have successfully captured the "high-fashion gym" aesthetic, while Vuori has dominated the "coastal comfort" niche. These competitors have aggressively moved into Lululemon’s territory, offering premium alternatives to a consumer base that is increasingly open to brand-switching.

Selective Consumer Spending

In the macro-economic climate of late 2025, even the affluent "Lulu-loyalist" is becoming more discerning. High interest rates and lingering inflation have led to "pantry loading" of activewear—where customers buy only what they need, often waiting for the "We Made Too Much" sales rather than buying at full price.

II. The International Powerhouse: Why China is the New Frontier

If the U.S. market is a cooling engine, China is a rocket ship. In a stunning display of brand resonance, Lululemon’s revenue in Mainland China surged by 46% this past quarter.

The Status Symbol of "Wellbeing"

In China, Lululemon has transcended the "yoga" label. It has become a holistic lifestyle status symbol. The brand has masterfully tapped into the "Upper Middle Class" desire for health and community. By hosting massive "Be Well" festivals and community runs in cities like Shanghai and Shenzhen, they have built a deeper emotional connection with consumers than their traditional sportswear rivals.

Expanding the Map

Lululemon isn't just sticking to the Tier-1 cities. The 2025 expansion plan successfully penetrated Tier-2 and Tier-3 cities, where the appetite for Western premium brands is growing faster than the local supply. This geographic diversification is currently acting as a massive financial cushion for the company.

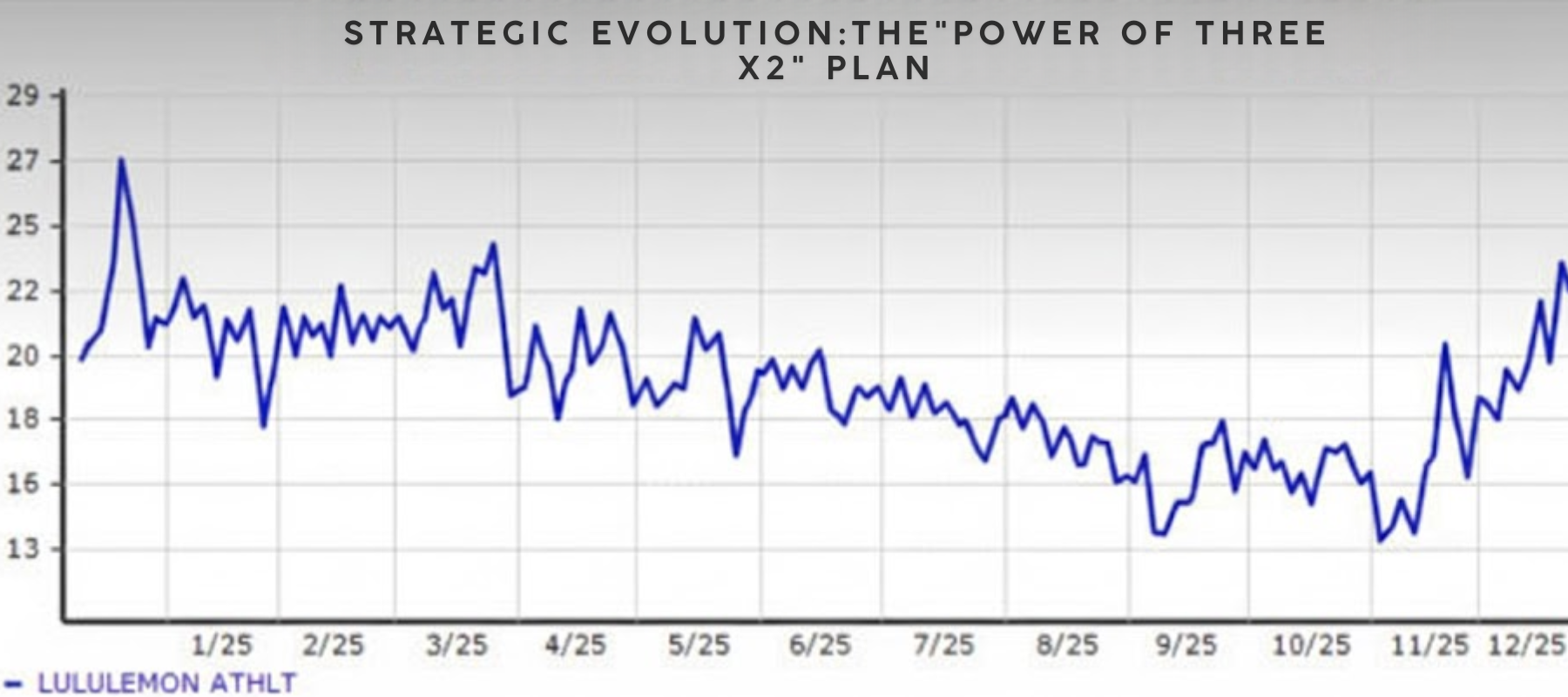

III. Strategic Evolution: The "Power of Three x2" Plan

Despite the domestic softness, Lululemon is sticking to its ambitious "Power of Three x2" growth strategy. This plan aims to double men’s revenue, double digital revenue, and quadruple international revenue by the end of 2026.

The Men’s Category: The $2 Billion Opportunity

One of the brightest spots in the 2025 report is the Men’s division, which now accounts for nearly 25% of total sales. By expanding into "work-to-gym" apparel like the ABC Pant and high-performance training gear, Lululemon is successfully proving it isn't just for women.

Footwear and Accessories

Lululemon’s foray into footwear—including the Beyondfeel running shoe—has finally begun to gain traction. While it represents a small portion of the total business, it allows the brand to offer a "head-to-toe" solution, increasing the average transaction value per customer.

IV. A New Era of Leadership: The 2026 Transition

The most significant news of December 2025 is the leadership transition. With Calvin McDonald set to step down in early 2026, the brand is entering a period of self-reflection.

The interim leadership team, led by CFO Meghan Frank, has already promised a "Product Reset." Here is what is on the horizon for 2026:

- 35% Newness: A massive portion of the Spring/Summer 2026 collection will feature entirely new designs and fabric technologies.

- Expansion into India and the Middle East: Leveraging new franchise partnerships to enter high-growth regions.

- Sustainability Focus: Accelerating the use of "enzymatically recycled" nylon to meet the demands of the eco-conscious Gen Z shopper

V. The Verdict: Resilience in the Face of Change

Lululemon is currently a tale of two markets. The "softness" in the U.S. is a wake-up call that even the strongest brands cannot rely on past glory. However, the explosive international growth proves that the brand's core value proposition—quality, community, and style—is a universal language

If the 2026 product refresh successfully reignites the North American flame while the China surge continues, Lululemon will likely emerge from this transition stronger and more diversified than ever before

Post time: Dec-22-2025